September 2023

FINANCIAL WELLNESS

Data reveals gender gaps in health care savings

The cost of health care is a common concern among employees. Estimates show that an average 65-year-old couple retiring today will need about $296,000 to cover out-of-pocket health care costs in retirement.1 Women especially need to consider their health care expenses, given their longer life spans and generally lower incomes. In fact, a healthy woman can expect to pay $200,000 more in health care insurance premiums over her lifetime than a healthy man.2

With men and women having different health and financial needs, we wanted to learn more about the health care savings behavior of male and female employees participating in Bank of America Health Savings Accounts (HSAs). The resulting 2023: Gender Lens in Health Savings Accounts (HSA) report is our third gender lens study3 initiated to gain insights and identify opportunities to help close the financial wellness gap between men and women.

What we learned:

- Less than 10% of both men and women are contributing the maximum allowed to their HSA.4

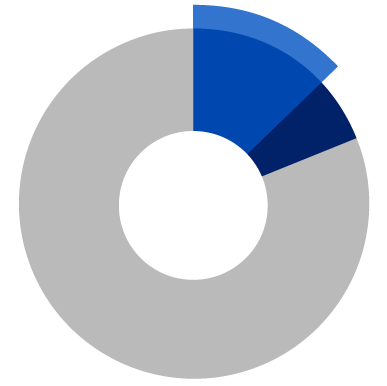

- More men (19%) than women (13%) have an HSA investment balance.4

- When it comes to saving or spending their HSA dollars, men are slightly more likely to be savers than women, with 53% of men having positive “in-year” net savings (contributions higher than withdrawals), vs. 50% of women. Men also have higher net dollar savings overall.4

More men (19%) than women (13%) have an HSA investment balance.4

Similar patterns can also be found in the data analyzed as part of Bank of America’s latest Participant Pulse report. The report also found that overall, women’s average financial wellness score (52) trails the average score of men (59).5

|

|

Did you know?2003: The year HSAs were first introduced 35.5 million HSAs as of year-end 20226 $104 billion in HSA assets6 24% HSA annual growth rate over the past 16 years6 |

Key takeaways

- Download the 2023: Gender Lens in Health Savings Accounts (HSA) report, which includes suggestions to help employees be better prepared to pay for health care.

- Talk with your Bank of America representative about these findings and strategies that can help improve employee wellness.

1 EBRI “Projected Savings Medicare Beneficiaries Need for Health Expenses Spike in 2021,” January 20, 2022. Note: These costs include deductibles, copays and premiums for Medicare Part A, Part B and Part D, as well as Medigap insurance costs. They do not include services not covered by Medicare, such as over-the-counter medications and most dental services.

2 HealthView Services, “Addressing the Women’s Longevity Gap,” September 2020 (most current data available).

3 Our first study focused on the behavior of 401(k) plan participants “2022: Gender Lens in Defined Contribution (DC) Plans,” Bank of America and Chief Investment Office, October 2022. Our second study provides a gender perspective on financial wellness of plan participants: “Employee Financial Wellness in America,” Bank of America and Chief Investment Office, December 2022.

4 Source: Bank of America, December 2022. Based on the records of 565,791 HSA participants. Calculations by Chief Investment Office.

5 Methodology: This report monitors plan participants’ behavior in our recordkeeping clients’ employee benefits programs, which comprise more than 4 million total participants with positive account balances as of June 30, 2023.

6 “2022 Year-End Devenir Health Savings Account Research Report,” March 30, 2023.