August 2023

BENEFITS FOCUS

Helping employees get the most from their benefits

Open enrollment is around the corner and it’s a key time to ramp up communications and education to help employees make informed decisions about their benefits. With inflationary pressures likely to continue through this year, employees will be leaning on the benefits you provide to help them pay for health care and prepare for retirement. This makes it especially important to arm employees with information, tips and tools to help them get the most out of their workplace benefits.

In fact, a best practice is to provide a steady cadence of communications in the months up to and beyond open enrollment to reinforce key messages, encourage positive actions and to help develop good habits to support holistic wellness. So, consider using communications activities planned for open enrollment to springboard into a yearlong program.

|

|

Did you know?Open enrollment season is an opportune time to encourage employees to check in on their 401(k) and make any adjustments to get and stay on track toward retirement goals. |

Take advantage of educational outreach and resources available to you and your employees, from emails we deliver directly to employees to an extensive range of webinars, articles, videos and tools that employees can conveniently access on our Education Center and health and benefit accounts Learn Center. You can also download resources to use in your company’s communication channels, such as ready-to-send emails, flyers, videos, web banners, posters and more, available on the Employee Communications Center.

Timely topic: Helping employees understand an HDHP with an HSA

With heath care costs continuing to rise, more employers are offering a high-deductible health plan (HDHP) as a way to lower premiums and give employees greater control over how they spend their health care dollars. However, many employees don’t fully understand HDHPs, how they compare with traditional health plans and how they pair with a Health Savings Account (HSA) to help them pay for out-of-pockets expenses. To help educate employees during open enrollment, consider the following resources.

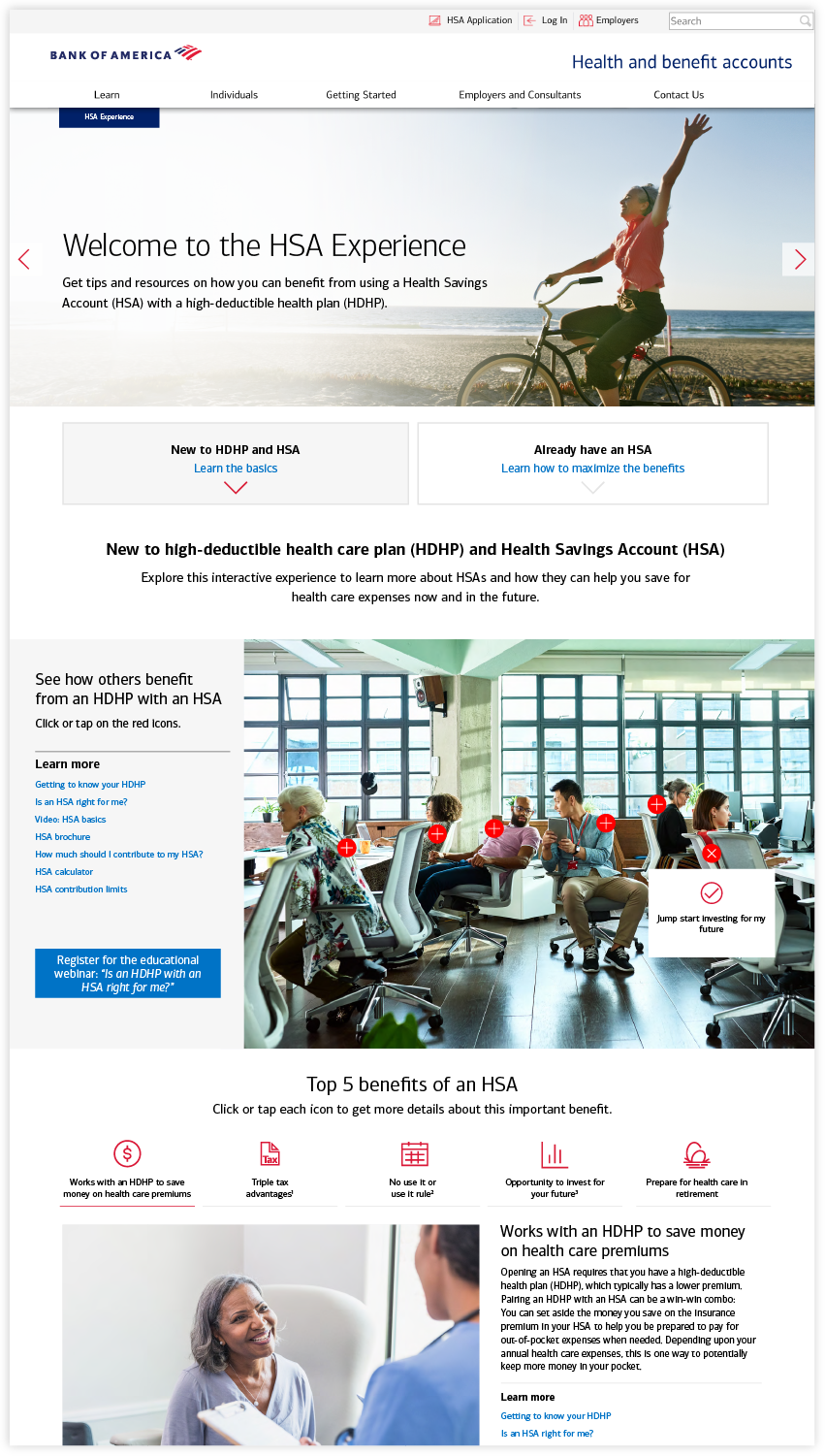

2023 HSA Experience

The HSA Experience is like a virtual health benefits fair, providing one convenient place where your employees can go to get information that will help them better understand their health benefit options and make informed decisions during open enrollment. This online experience provides tips and tools to help employees learn more about how an HSA works with an HDHP to help them plan for health care expenses in the coming year and into retirement.

Employees will be able to explore two different paths:

- New to HDHP and HSA focuses on the basics of HDHPs and how they work with an HSA.

- Already have an HSA is for those who have an HSA and want to make the most of their account. Topics include maximizing tax benefits, taking advantage of HSA investing and preparing for health care in retirement.

Benefits enrollment communications toolkits

Two communications toolkits are available to help you increase employee engagement with the HSA Experience and the Is an HDHP with an HSA right for me? webinar during open enrollment. Each toolkit contains downloadable resources you can use in your company’s communications channels.

Key takeaways

- Talk with your Bank of America representative about employee engagement strategies and to review the calendar of educational events.

- Promote the “Better together” webpage where employees can learn about the powerful benefits of contributing to both an HSA and a 401(k) and link to additional resources to find out more.

- Browse the Employee Communications Center for a range of downloadable resources you can use in your company’s communications channels to help employees learn, plan and take action.

Potential Tax Advantages: You can receive federal income tax-free distributions from your HSA to pay or be reimbursed for qualified medical expenses you incur after you establish the HSA. If you receive distributions for other reasons, the amount you withdraw will be subject to income tax and may be subject to an additional 20% tax, unless an exception applies. Any interest or earnings on the assets in the account are federal income tax-free. You may be able to claim a tax deduction for contributions you, or someone other than your employer, make to your HSA directly (not through payroll deductions). In addition, HSA contributions may reduce your state income taxes in certain states. Certain limits may apply to employees who are considered highly compensated key employees. Bank of America recommends you contact qualified tax or legal counsel before establishing an HSA.

Mutual Fund investment offerings for the Bank of America HSA are made available by Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S”), a registered broker-dealer, registered investment adviser, Member SIPC and a wholly owned subsidiary of Bank of America Corporation (“BofA Corp.”). Investments in mutual funds are held in an omnibus account at MLPF&S in the name of Bank of America, N.A., for the benefit of all HSA account owners. Recommendations as to HSA investment menu options are provided to Bank of America, N.A. by the Chief Investment Office (“CIO”), Global Wealth & Investment Management (“GWIM”), a division of BofA Corp. The CIO, which provides investment strategies, due diligence, portfolio construction guidance and wealth management solutions for GWIM clients, is part of the Investment Solutions Group (ISG) of GWIM.