July 2023

MATTERS THAT MATTER

The evolving composition of today’s households

Today’s households look very different than a generation ago. Lifestyle trends and changing financial circumstances are reshaping household compositions. Arrangements once seen as unique, such as unmarried partners, adult children living with parents or multi-generational households, are now perceived by many as traditional.

As employers think about their benefits programs and how best to engage their employees, it’s important to understand employees’ evolving living situations and how they view their own households, whether traditional or non-traditional, to ensure programs and messaging are relevant and inclusive. And because household transitions can trigger different emotions as well as financial needs, living arrangements may be another factor to consider in employees’ holistic wellness. As a first step in helping employees navigate these life changes, let’s take a closer at the trends.

Societal trends driving household makeup

Some of the factors influencing household composition include:

- Longer life expectancy and financial issues, such as student debt, are some of the reasons parents and adult children are choosing to live together, with multi-generational and extended family members often in the mix.

- Declining interest in marriage in the U.S.—down 60% over the last 50 years1—contributes to the prevalence of households with unmarried partners; while a high divorce rate may be a factor in the number of single-parent households.

- Different attitudes toward marriage, feminism, LGBTQ+ rights and related social issues also play a role in the evolving nature of households.

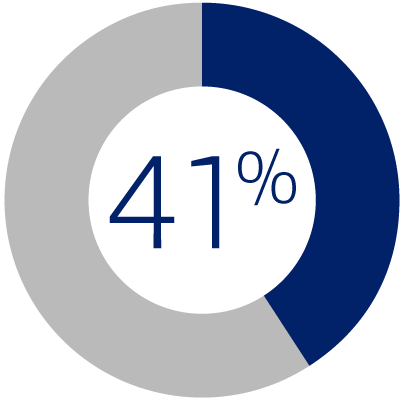

of those living in what they consider to be non-traditional households say their arrangement is driven by financial circumstances.

Who pays the bills?

The transition to a different household structure can affect finances, from basic needs, such as groceries and utilities, to larger expenses like furniture or home improvements needed to accommodate a new household composition. Expenses in non-traditional households tend to be equally split among members, while older generations and men are more likely to take on household expenses in what they identify as traditional settings.

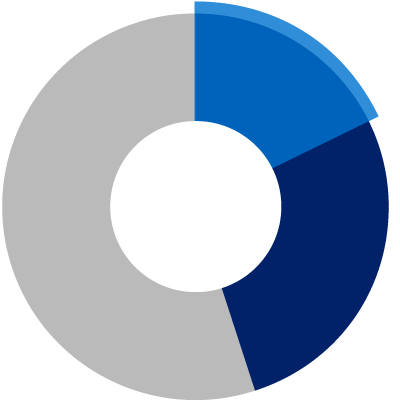

While 45% of people transitioning to a new household structure took on more expenses, 18% saw a decline because of cost-sharing.

Household happiness

Household structure can also influence employees’ happiness and well-being. Those who have chosen their living arrangement, whether traditional or non-traditional, generally feel more positive, stable and in control. If, however, people feel pushed into their living situation due to circumstances out of their control, they tend to have more negative feelings.

Key takeaways

- Being mindful of today’s various types of households can help you engage employees in relevant and inclusive ways and provide insights to help you support them as they navigate different living situations.

- Financial needs and responsibility may shift as employees transition to different household structures. Consider offering guidance and tools they can use to make financial decisions for their households.

- Consider enhancing holistic wellness programs that can help support employees’ financial and mental well-being across different living situations.

1 Axios, “America the single,” February 2023.

Source for this article unless otherwise noted: Bank of America Proprietary Market Landscape Insights, March 2023. Surveys conducted among general consumers (clients and prospective clients).