June 2023

#TRENDING

Taking the pulse on participant financial wellness

Looking at participant behaviors and activities within our recordkept plans helps us check in on how they are doing within the current economic environment and can help identify ways we can support them. Highlights from our first quarter 401(k) Participant Pulse report include:

- Fewer participants took loans compared to 4Q 2022, but those who did took higher loan amounts.1

- Participants’ average account balances decreased compared to 1Q 2022, but we saw an increase in participant contribution rates, up 24% in March 2023 vs. March 2022.1

- Economic conditions seem to impact participant distributions. New hardship withdrawals increased 15% quarter over quarter and 33% year over year.1

These findings are important to view through the lens of increasing consumer unease around inflation.

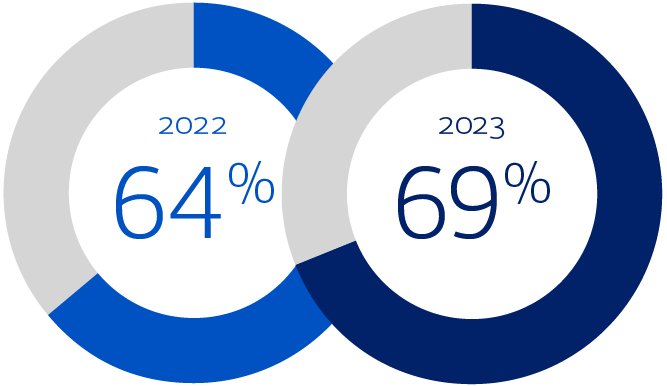

69% of consumers say inflation is a concern in 2023, up from 64% last year.2

Rising inflation has had a prolonged impact, topping the list of consumer concerns for a year now.2 In fact, 12% of consumers have postponed retirement in the face of inflation and market variability.2

Key takeaway

- With inflationary pressures certain to continue through the year, consider how you can support employees by providing access to educational resources and guidance on saving money, managing expenses and budgeting.

1 Bank of America 401(k) Participant Pulse, March 2023. This report monitors plan participants’ behavior in our proprietary employee benefits programs, which comprise 3 million total participants with positive retirement balances as of March 31, 2023.

2 Bank of America Proprietary Market Landscape Insights Study, March 2023. Surveys conducted among general consumers (clients and prospective clients).